In the latest forecast published by the IMF, Hungary is listed among the economically strongest EU member states, with the least expected GDP loss in 2020, and an impressive comeback in 2021.

The International Monetary Fund publishes its forecasts twice a year. The latest edition was published in October 2019, and the new one has just become accessible. In that, they are referring to the current situation as “The Great Lockdown”, and they are analyzing the consequences of the coronavirus pandemic in their latest, April 2020 world economy forecast.

They have consulted numerous epidemiologists, public health experts, and infectious disease specialists working on therapies for COVID-19. Based on that, they have come up with a baseline scenario, in which the pandemic should fade in the second half of 2020, meaning that containment efforts can be gradually unwound then. They expect that the economic landscape will be altered significantly, making a greater involvement of governments and central banks necessary in the economy.

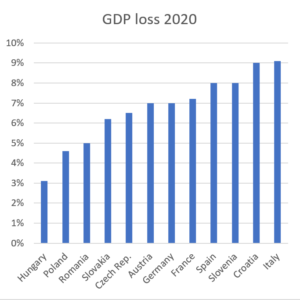

In its statistical analysis, the IMF expects Hungary to suffer an annual 3.1% GDP loss in 2020, which is the best expected outcome in the region. In comparison, Austria is expected to lose 7%, Croatia 9%, Slovakia 6.2%, Poland 4.6%. For bigger EU member states, even greater losses are expected, with Germany to lose 7%, France 7.2%, Spain 8.0%, and Italy 9.1%.

At the same time, the IMF expects that Hungary will be on a growth curve again in 2021, with a 4.2% GDP increase. Economic relief measures already in place will certainly play a role in stabilization and recovery.

Inflation in Hungary was around 3.4% in 2019. According to the IMF outlook, it will be again around 3.3% in 2020, and it will decrease further in 2021, reaching a value as low as 3.2%.

The rate of unemployment is another important indicator. While it was around 3.4% in 2019, the figure for 2020 will probably be around 5.4%, due to the economic crisis. However, this will decrease again in 2021 to 4.0%.

For years, Hungary has been one of the best options for moving your business to Europe thanks to the lowest corporate tax in the EU at only 9% and the quick and easy procedure with registration in just 4-5 business days, complete with an immediate EU VAT number.

Currently the biggest obstacle to company formation in Hungary by foreigners is the travel ban, since usually you would need to be present in person to open a corporate bank account for your Hungarian company. However, banks are currently changing their procedures, which might remove that obstacle in the nearest future – while all other procedures are handled uninterrupted. Moreover, if you make all preparations for setting up your Hungarian company still during the lockdown, you can get a head start on your competitors once restrictions are lifted.

CONTACTE CON NOSOTROS

Company modification is the official procedure through which a lawyer helps you change the core data of your Hungarian company with the Company Registry. One of the cases you need this procedure is when there is a change to the address of any of the owners and main executives.

Leer más

Company modification is the official procedure through which a lawyer’s help you can change the core data of your Hungarian company with the Company Registry. One of the cases when you need this procedure is when your company is hiring an auditor.

Leer más