How do you calculate salary and contributions in Hungary? – Employment in Hungary

There are four terms relevant for calculating salary and contributions in Hungary

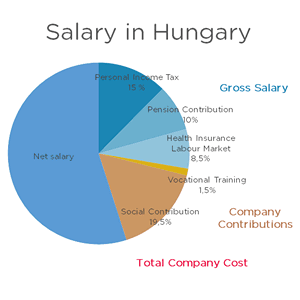

The gross salary is what you usually agree on with your employee, and what you put in the labor contract. Employees have to pay taxes and contributions from that (these are the employee’s payroll taxes), which your company deducts and forwards to the authorities for your employees. This way only the net salary is paid to the employee.

Moreover, your company will have to pay contributions for employing someone. These are called employer’s taxes. The sum containing the gross salary (net salary + employee’s taxes) and the employer’s taxes is the total company cost. This is what the given employee actually costs your company.

What is the minimum salary in Hungary?

Minimum salary depends on the requirements of the position. For a position without a need for any qualification the minimum salary for a basic, 40-hour week in 2019 is gross HUF 149,000 (ca. EUR 460) / month, while the guaranteed minimum salary for positions requiring secondary education is gross HUF 195,000 (ca. EUR 600) / month.

The more complex the job you want to assign to your employee, the higher qualifications they will need to be able to perform the job properly. Accordingly, their salary will need to be higher as well.

Let’s see an example: how do you calculate salary and contributions in Hungary?

Gross salary: HUF 195,000

Deductions (employee’s taxes):

- Health insurance and labor market contribution: 8,5%

- Pension contributions: 10%

- Personal income tax: 15%

Net salary: HUF 195,000 – (195,000*0.15+195,000*0.10+195,000*0.085) = HUF 129,675

Employer’s taxes:

- Vocational training contribution: 1,5%

- Social contributions: 19,5%

Total company cost = gross salary + employer’s taxes

HUF 195,000 + 195,000*0,195 + 195,000*0,015 = HUF 235,950

Tax relief is available under specific conditions. You will be able to discuss them with your accountant. You can also check out our interactive salary calculator on the below link.

Updated: 07 January 2019

التواصل

تواصل معنا اليوم

من الإثنين إلى الجمعة

9 صباحًا - 5 مساءً بتوقيت وسط أوروبا

Helpers Hungary Kft

Budapart Gate

Dombóvári út 27

Budapest 1117, Hungary

إذا كنت تزورنا، يرجى استخدام المدخل A والتوجه إلى الطابق الثاني.