International businessmen typically lead a global lifestyle. As a result, time is especially important them, which makes the ability to travel visa-free an invaluable investment for them, while it costs only a small percentage of their net worth. The immigrant investor programs available in Europe provide such an opportunity, offering either citizenship or permanent resident permits to businessmen, enabling them to travel without any delays in the Schengen visa zone.

On the other hand, another reason for businessmen applying for European residency is their consideration for their families, either to provide their children with increased education opportunities, or to facilitate transferring their wealth to the next generation in a more tax-friendly environment, as many of the investors relocating to Europe come from countries that do not have high stability of asset security.

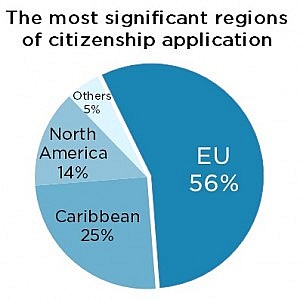

Europe is the most popular region in terms of second residence or citizenship applications, accounting for over half of the total number of applications in immigrant investor programs. Most of the investors applying for second residency are from Pakistan and Lebanon, while many of them come from Egypt, Syria, or even the USA or Russia. European countries offer various conditions to these businessmen, so each of them can find the offer that suits their needs best.

Of all the European countries, Hungary offers the most cost-effective solution. Here, for a EUR 300,000 investment refundable at the end of a five-year investment period, investors get a permanent resident permit for themselves and their families (investor, spouse and minor children). The cost of the program is only the EUR 60,000 government processing fee (and the interests of the invested sum).

Moreover, Hungary provides a favourable business environment, with a relatively low corporate tax rate of 10%, and an income tax rate of 16% – however, investors are not obliged to become tax residents, while they can travel freely in the Schengen visa zone. This way businessmen may benefit from the Hungarian immigrant investor program even if spending a large part of their time in higher taxed countries, such as France or Italy (both with a top income tax rate of 45%).

For more information on the Hungarian investor immigration program, please click here or contact Mo Shaban at mo@helpers.hu, or call our office Monday through Friday 9 a.m. – 5 p.m. CET on +36.1.317.8570. We would be happy to offer you free consultation, so you can decide what would be the best solution for you.

اتصل بنا

As of 1 January 2024, new Hungarian residency options are available to third-country nationals living in Hungary or planning to move here.

اقرأ المزيد

Are you worried about the new Hungarian immigration law? Are you looking for rock solid information? Not sure who to trust? You can ask the Hungarian Immigration Office directly.

اقرأ المزيد