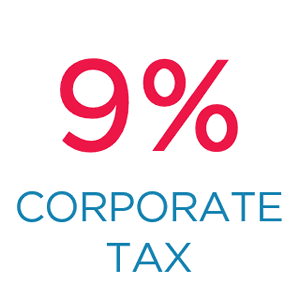

9% corporate tax to make running a business in Hungary even more economical

If you want to set-up a company in the EU, Hungary has been the best choice for a long time. Now running a business in Hungary will become even more economical thanks to new legislation on 9% corporate tax from 2017.

If you want to set-up a company in the EU, Hungary has been the best choice for a long time. Now running a business in Hungary will become even more economical thanks to new legislation on 9% corporate tax from 2017.

Company formation in Hungary

Quick and easy company formation, immediate international VAT number registration and low starting capital made Hungary an ideal target for non-EU businessmen who wanted to start activities in the European Union. The low corporate tax and the easy residency application process made Hungary even more attractive for running a business in Europe.

Running a business with even lower corporate tax

Corporate tax in Hungary is currently as low as 10%. Thanks to new legislation, corporate tax will be even lower, 9% starting from 2017. This will make setting up and running a business in Hungary – and relocating to Europe through Hungarian company formation – even more cost-effective than it has been up till now.

Watch this space for more information!

Keep an eye on our blog or like our Facebook page to make sure you never miss any news related to business in Hungary. For more information, you may also contact our office by calling +36-1-317-8570, or writing an e-mail to us to info@helpers.hu. We are happy to answer any questions. Let us be your helpers in Hungary!

Iletişim

Bugün iletişime geç

Pazartesi – Cuma

9 – 17 Orta Avrupa Saati

Helpers Hungary Kft

Budapart Gate

Dombóvári út 27

Budapest 1117, Hungary

Bizi ziyarete geliyorsanız lütfen A girişini kullanın ve 2. kata gelin.