Invoicing in Hungary: Booklet or software? Accountancy quick guide

In Hungary, issuing invoices is strictly regulated. First of all, if you sell any of your products, either merchandise or services, you will always need to issue an invoice with an invoice number, to which both you and your customer will be able to refer later. For this purpose, a random piece of paper, a Word or Excel file will not be enough: you will have to issue your invoice more “officially”. There are two main methods for this.

In Hungary, issuing invoices is strictly regulated. First of all, if you sell any of your products, either merchandise or services, you will always need to issue an invoice with an invoice number, to which both you and your customer will be able to refer later. For this purpose, a random piece of paper, a Word or Excel file will not be enough: you will have to issue your invoice more “officially”. There are two main methods for this.

Last updated on 28 March 2023.

The two main methods of invoicing in Hungary

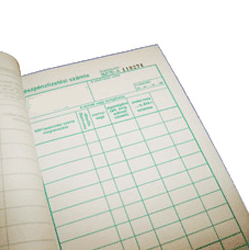

- With your tax number, you can buy an “invoice booklet” in any Hungarian office supply store. This is very much like a notepad with officially numbered pages; on each page, there is a grid which you have to fill with the relevant data whenever you want to sell something. The booklet is constructed in a way that whenever you issue an invoice, you automatically create two carbon copies: you give the original to your client, the first copy to your accountant, and keep the second copy for future reference. However, this is not very convenient.

- Which is more convenient: you may also use licensed Hungarian invoicing software (foreign software are not acceptable). As licensed software are constantly updated to meet the latest regulations, they will always remind you to fill in all the necessary data, so you can rest assured that your invoices are in full compliance with the local regulations, accurate and valid. Moreover, with an invoicing software you can issue invoices in both Hungarian and English, and even in PDF format, making handling your invoices easy and user-friendly. The licence fee for such programs is usually quite reasonable considering the amount of work they save for your business, and we would be more than happy to assist you learn how to use such a program.

UPDATE: As of 1 July 2020, all Hungarian B2B invoices must be immediately reported to the Tax Authority, for which using an invoicing software is an ideal solution. Learn more about the changes here.

UPDATE: As of 4 January 2021, every invoice must be registered with the Hungarian Tax Office as soon as possible. As a result, it now makes a lot more sense to use invoicing software. Thanks to modern solutions, most of these are already available as mobile apps, so you can issue invoices on the go as easily as filling in an invoice booklet.

You can find more information on invoicing in Hungary, or accountancy and bookkeeping in general (which are basically the same in Hungary) by clicking here. If you need assistance, please visit our accountancy department, contact us through the form below, or call our office on +36.1.317.8570.

Контакт

Обратитесь к нам сегодня

Пон-пт

9:00 - 17:00

Helpers Hungary Kft.

Budapart Gate

Dombóvári út 27

Budapest 1117, Hungary

Если вы пришли к нам в гости, воспользуйтесь входом A и поднимитесь на 2-й этаж.