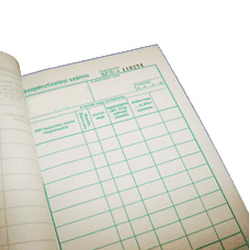

In Hungary, issuing invoices is strictly regulated. First of all, if you sell any of your products, either merchandise or services, you will always need to issue an invoice with an invoice number, to which both you and your customer will be able to refer later. For this purpose, a random piece of paper, a Word or Excel file will not be enough: you will have to issue your invoice more “officially”. There are two main methods for this.

You can find more information on invoicing in Hungary, or accountancy and bookkeeping in general (which are basically the same in Hungary) by clicking here. If you need assistance, please visit our accountancy department, or contact key account manager Julia Sipos at julia@helpers.hu, or call our office on +36.1.317.8570.

CONTACTE CON NOSOTROS

Tax returns season is starting soon in Hungary. Drafts created by the Tax Authority become available next week; the deadline for submission is 21 May 2024.

Leer más

According to a new proposal, digital companies where more than 60% of the employees are third-country nationals could enjoy significant tax benefits.

Leer más