How to reduce payroll taxes in Hungary?

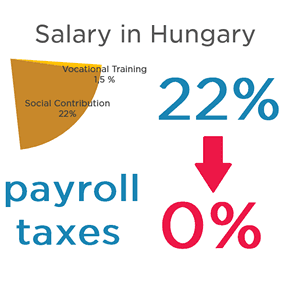

In this article we will show 5 ways your Hungarian company can reduce payroll taxes. Previously we have already written about the payroll taxes and the components of salary in Hungary. A Hungarian company has to pay the following two taxes on top of the gross salary (contracted salary):

- 19,5% social contribution tax

- 1,5% vocational training tax

In this article we will show 5 ways your Hungarian company can reduce payroll taxes. Previously we have already written about the payroll taxes and the components of salary in Hungary. A Hungarian company has to pay the following two taxes on top of the gross salary (contracted salary):

- 19,5% social contribution tax

- 1,5% vocational training tax

For an updated version, please click here.

Reduce payroll taxes

The 19,5% social contribution tax is a major payroll cost for companies. However, in some special cases it can be reduced to 9,75%, or sometimes even to 0% (up to a certain point), as the authorities may grant a significant payroll tax relief for certain groups. Before you recruit staff we recommend you consider the following options.

Option 1: Hire employees of age under 25 or over 55

The company pays only 9,75% social contribution tax on the gross salary up to HUF 100,000 until the employees turn 25 or after they have turned 55.

Option 2: Hire career entrants

The company has 0% social contribution tax liability on the gross salary up to HUF 100,000 in the first two years of the employment. The tax authority has to verify that the career entrant has less than 180 days of employment.

Option 3: Hire employees with disabilities

The company pays 0% social contribution tax on their gross salary up to HUF 276,000 as long as the employee has a valid rehabilitation card.

Option 4: Hire women returning from maternity leave

The company has 0% social contribution tax liability on the gross salary up to HUF 100,000 in the first two years and 9,75% liability in the third year. Depending on the number of children the tax deduction can be more.

Option 5: Hire jobseekers

The company has 0% social contribution tax liability on the gross salary up to HUF 100,000 minimum in the first two years and 9,75% liability in the third year if the National Labor Office verifies the job candidate as permanent jobseeker.

Payroll tax relief in Hungary

Authorities let companies reduce payroll taxes if they employ workforce who have difficulties entering the labor market. Members of the above groups may prove as eager, skilled, and earnest employees as anyone else, while employing them grants you significant payroll tax relief.

We hope the above list will help you in recruitment and more conscious business planning. Please contact our accountancy department on finance@helpers.hu if you would like to know more details or would be interested in further tax deduction options.

Last updated: 12 June, 2018

For an updated version, please click here.

Контакт

Обратитесь к нам сегодня

Пон-пт

9:00 - 17:00

Helpers Hungary Kft.

Budapart Gate

Dombóvári út 27

Budapest 1117, Hungary

Если вы пришли к нам в гости, воспользуйтесь входом A и поднимитесь на 2-й этаж.