Why should I use an invoice booklet in Hungary?

A properly issued invoice is essential for keeping your company compliant. Without it, you might be faced with being charged extra hours for accountancy, tax audits and even fines.

A properly issued invoice is essential for keeping your company compliant. Without it, you might be faced with being charged extra hours for accountancy, tax audits and even fines.

Last updated on 24 March 2023.

Options for issuing invoices in Hungary

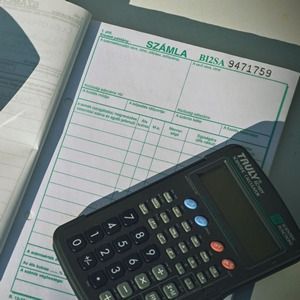

In many countries, invoices can be issued by Word or Excel. However, Hungarian companies must either use an official invoice booklet or an invoicing software licensed by the Hungarian Tax Office. Let’s look at the pros and cons of using an invoice booklet.

Pro: Easy and cost-effective for small volumes

First and foremost, and invoicing booklet is easy to get. You can walk into any stationary shop and buy it. It is also very cheap, as it only costs a few Euros.

Thus, it might be the perfect option in the first few months of the company’s operation, when only a few invoices per month are issued.

Con: Hungarian only

However, since the booklets are available in Hungarian only, you have to learn how to correctly fill them out, and what to write in each little cell. Moreover, the total payable has to be written out in letters, not just with numbers, which requires the owner to perfect their Hungarian a bit sooner than they might be ready to.

Con: Paper copies

Another disadvantage is always having to carry around paper copies. All invoices are issued in triplicate. The original (with the green grid) is sent to the buyer. The first carbon copy (with the red grid) must be given to the accountant. Finally, the second carbon copy (with the black grid) is to remain with the business owner. In the digital age, having to take care of more bits of paper than strictly necessary can quickly become cumbersome.

Finally, the real disadvantage will show once your business picks up and you’ll need to issue several tens or even hundreds of invoices a month. At this stage, all the work hours you’ll have to spend on this will likely come out more expensive than investing in an invoicing software.

UPDATE: As of 4 January 2021, every invoice must be registered with the Hungarian Tax Office as soon as possible. As a result, it now makes a lot more sense to use invoicing software. Thanks to modern solutions, most of these are already available as mobile apps, so you can issue invoices on the go as easily as filling in an invoice booklet.

Contact

Contact us today

Monday - Friday

9am - 5pm CET

Helpers Hungary Kft

Budapart Gate

Dombóvári út 27

Budapest 1117, Hungary

If you’re visiting us, please use entrance A and come to the 2nd floor.