Where is corporate tax the lowest in Europe?

When setting up a company, there are a lot of factors you need to consider, but the most important is certainly taxation. After all, no matter how great your performance is if you end up paying half of your profits to the government, right? Paying taxes is inevitable, but if you spend some time looking around and evaluate your options, you might save a lot on taxes.

When setting up a company, there are a lot of factors you need to consider, but the most important is certainly taxation. After all, no matter how great your performance is if you end up paying half of your profits to the government, right? Paying taxes is inevitable, but if you spend some time looking around and evaluate your options, you might save a lot on taxes.

What is corporate tax?

A corporate tax (also known as profit tax) is a levy placed on the profit of a company. The profit of the company is calculated by deduction of all expenses including direct and general expenses from the revenues. Rules surrounding corporate taxation vary greatly around the world and must be voted upon and approved by the government to be enacted. Profit tax may be collected in one amount yearly, or in several installments throughout the year.

Can I operate a company remotely?

In the digital age, you don’t need to register a company in your country of residence, you can operate and manage your business remotely. You will need a reliable accountant and a virtual mailing address, but with a good provider none of that will be an issue.

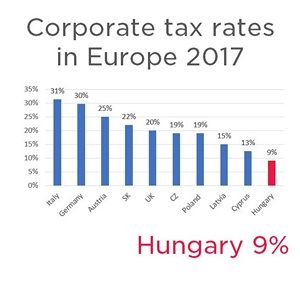

So, what options are there in Europe?

Let’s see the most popular destinations for start-ups:

| Corporate tax rates in Europe 2017 | |

| Italy | 31% |

| Germany | 30% |

| Austria | 25% |

| SK | 22% |

| UK | 20% |

| CZ | 19% |

| Poland | 19% |

| Latvia | 15% |

| Cyprus | 13% |

| Hungary | 9% |

Looking at the tax rates, Hungary is clearly most advantageous place to set up your business. The 9% flat corporate tax rate was introduced January 1st 2017 to invite more foreign investment and stimulate more ventures by local and international professionals. (Previously, the rates were 10% up to 1,7 M EUR and 19% on the part above the threshold.) This is currently the lowest tax rate in Europe.

When do I pay the corporate tax?

After the first operating year of the company, the year closing report is due May 31st for the previous fiscal year (registration date – December 31st). From the second year on, the corporate tax advances: are paid quarterly on the 20th of July, October, January and April, in 4 equal installments, calculated on the basis of the previous closed fiscal year

Do you want to know more about taxation in Hungary? Do you need a reliable accounting partner? Do you need help setting up your own company in Hungary? Contact us at info@helpers.hu or call our office on +36 1 317 8570 to receive free consultation.

Contact

Contact us today

Monday - Friday

9am - 5pm CET

Helpers Hungary Kft

Budapart Gate

Dombóvári út 27

Budapest 1117, Hungary

If you’re visiting us, please use entrance A and come to the 2nd floor.